Credit Score

What is a Credit Score?

Credit scores influence the credit that’s available and the terms (interest rate, etc.) that lenders may offer. It’s a vital part of credit health.

Knowledge – about your credit, about the impact it has on your future, about the world in general – is powerful. If you’re on the lookout to be better versed about your credit, consulting your FICO Score could be a great place to start. A FICO Score is a powerful measure of your creditworthiness as a lender might see it.

FICO Scores are used in 90% of credit decisions, so they’re a very good barometer of how your credit can look to potential lenders. Scoring ranges are just one of the tools lenders can use to link ranges of values with associated characteristics and metrics at-a-glance, allowing them to make more informed lending decisions quickly and fairly.

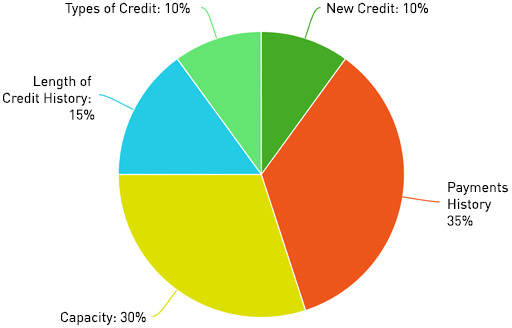

How Credit Scores are Calculated

- 35%: Payment history;

- 30%: Amounts owed on credit and debt;

- 15%: Length of credit history;

- 10%: New credit;

- 10%: Types of credit used

• All of these factors are considered in other credit score models, so it’s safe to say that if you have a strong FICO score you likely have a good score with other models as well. However, for some people, the weight of these categories can vary. For example, people who haven’t been using credit for very long will be factored differently than those with a longer credit history, according to FICO. So, the importance of any one of these factors depends on the overall information in your credit report.

• That’s why it’s a good idea to not get too hung up on the specific number of your credit score. Instead, focus on what areas of your credit are strong and which ones you might want to work on.

About FICO Scores

The most widely used credit scores are FICO® Scores, the credit scores created by Fair Isaac Corporation. 90% of top lenders use FICO® Scores to help them make billions of credit-related decisions every year. FICO® Scores are calculated based solely on information in consumer credit reports maintained at the credit reporting agencies.By comparing this information to the patterns in hundreds of thousands of past credit reports, FICO® Scores estimate your level of future credit risk.

FICO Scores at each credit bureau

You have FICO® Scores for each of the three credit bureaus: Equifax, TransUnion and Experian. Each FICO® Score is based on information the credit bureau keeps on file about you.

FICO® Scores from each credit bureau consider only the data in your credit reports at that bureau. Your credit scores may be different at each of the credit bureaus. If your current scores from the credit bureaus are different, it’s probably because the information those bureaus have on you differs.

Your FICO Scores will change over time

As the information in your credit report changes, so will any new credit score based on your credit report. So your FICO® Scores from a month ago are probably not the same score a lender would get from the credit bureau today.

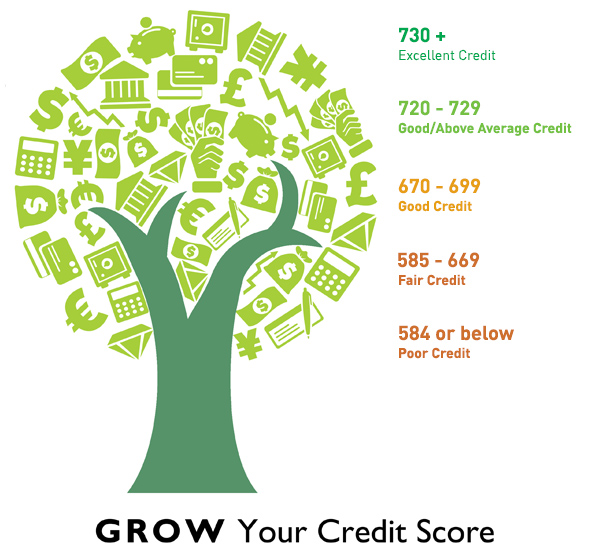

Credit Score Range Definitions

• 800 +: Indicates an exceptional FICO Score and is well above the average credit score. Consumers in this range may experience an easy approval process when applying for new credit. Approximately 1% of consumers with a credit score of 800+ are likely to become seriously delinquent in the future.

• 740 to 799: Indicates a very good FICO Score and is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. Approximately 2% of consumers with a credit score between 740 to 799 are likely to become seriously delinquent in the future.

• 670 to 739: Indicates a good FICO Score and is in the median credit score range. Consumers in this range are considered an “acceptable” borrower. Approximately 8% of consumers with a credit score between 670 to 739 are likely to become seriously delinquent in the future.

• 580 to 669: Indicates a fair FICO Score and is below the average credit score. Consumers in this range are considered subprime borrowers and getting credit may be difficult with interest rates that are likely to be much higher. Approximately 28% of consumers with a credit score between 580 to 669 are likely to become seriously delinquent in the future.

• 579 and lower: Indicates a poor FICO Score and is considered to be poor credit. Consumers may be rejected for credit. Credit card applicants in this range may require a fee or a deposit. Utilities may also require a deposit. A credit score this low could be a result from bankruptcy or other major credit problems. Approximately 61% of consumers with a credit score under 579 are likely to become seriously delinquent in the future.

Direct link to Fair, Isaac & Co: http://www.myfico.com/CreditEducation/articles/